Every broker has seen this conversation.

The trade executed. The price matches the feed. The timestamps line up. The hedge is placed.

And yet, someone is unhappy.

Operations says the trade is correct. Liquidity says the fill is fair. Risk says the numbers add up.

Still, the P&L feels wrong.

The Trade That Starts an Argument

It usually begins with a harmless sentence:

“Can someone double-check this?”

No accusation. No alarm. Just a sense that something doesn’t sit right.

Nothing is broken. But something doesn’t reconcile.

These are the hardest trades to deal with — not because they’re wrong, but because they’re technically correct.

Why “Correct” Is Not the Same as “Neutral”

Most broker systems are excellent at verifying correctness:

- Was the execution price valid?

- Was the trade confirmed?

- Did the hedge go through?

- Did the LP acknowledge the fill?

But correctness answers only one question:

“Did this trade follow the rules?”

It does not answer:

“Did this trade behave as expected inside the book?”

That gap is where many quiet disputes are born.

The Timing Nobody Owns

In most broker stacks, timing lives between teams.

Execution owns the click. Risk owns the exposure. Operations owns the logs. Liquidity owns the hedge.

But nobody owns the space between.

If a hedge is placed 12 seconds later instead of 2, no alert fires. No rule breaks. No system complains.

Yet the outcome changes.

And when outcomes change without visible errors, humans start arguing.

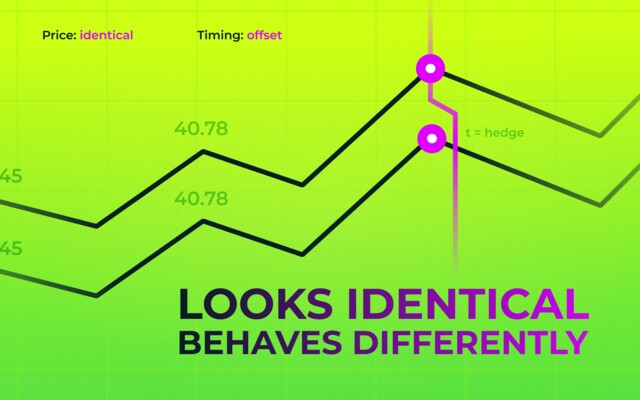

Why LPs and Brokers See the Same Trade Differently

From the broker’s perspective:

- The trade was market-priced.

- The hedge was placed.

- The fill was confirmed.

From the LP’s perspective:

- The hedge arrived late.

- Liquidity had already shifted.

- The price still fell within tolerance.

Both sides are right.

And that’s the problem.

Disputes don’t come from errors anymore. They come from interpretation of timing.

The Cost of “Within Tolerance”

Tolerance is meant to absorb noise.

But when many trades land near the edge of tolerance, patterns emerge:

- fills skew slightly one-sided,

- hedge costs creep up,

- session P&L drifts,

- LP performance comparisons become fuzzy.

Nothing looks dramatic. But month-end numbers quietly disagree with expectations.

That’s when internal emails start.

Why These Disputes Are Becoming More Common

Ten years ago, disputes were about:

- bad prices,

- failed executions,

- clear slippage.

Today, systems are faster and cleaner.

What remains are edge cases:

- micro-delays,

- queue positioning,

- session boundaries,

- reconciliation windows.

As execution improves, post-execution interpretation becomes the battleground.

The Human Reaction Pattern

When a trade is wrong, systems handle it.

When a trade is ambiguous, humans step in.

And humans do what they always do:

- defend their domain,

- trust their dashboards,

- assume the other side missed something.

The argument isn’t about the trade. It’s about ownership.

Why “Looks Fine” Is a Dangerous Verdict

“Looks fine” usually means:

- no rule was violated,

- no alert was triggered,

- no threshold was crossed.

It does not mean:

- the trade was neutral to the book,

- the timing was optimal,

- the exposure behaved as expected.

When many trades look fine individually, they can still misbehave collectively.

The Shift Brokers Are Slowly Making

Instead of asking:

“Was this trade correct?”

More brokers are now asking:

“What happened to this trade after execution?”

This shifts focus from validation to behavior.

From checking boxes to observing patterns.

What Actually Reduces These Arguments

Not more meetings. Not longer email threads.

But shared visibility into:

- execution-to-hedge timing,

- session-based drift,

- LP response patterns,

- post-trade exposure behavior.

When timing becomes measurable, arguments become rare.

Final Thought

The hardest trades to manage today are not the bad ones. They are the ones that look fine.

Because “fine” leaves room for interpretation.

And interpretation is expensive.

The more automated and clean execution becomes, the more brokers must understand what happens after the click.

That’s where most modern disputes — and quiet losses — are born.