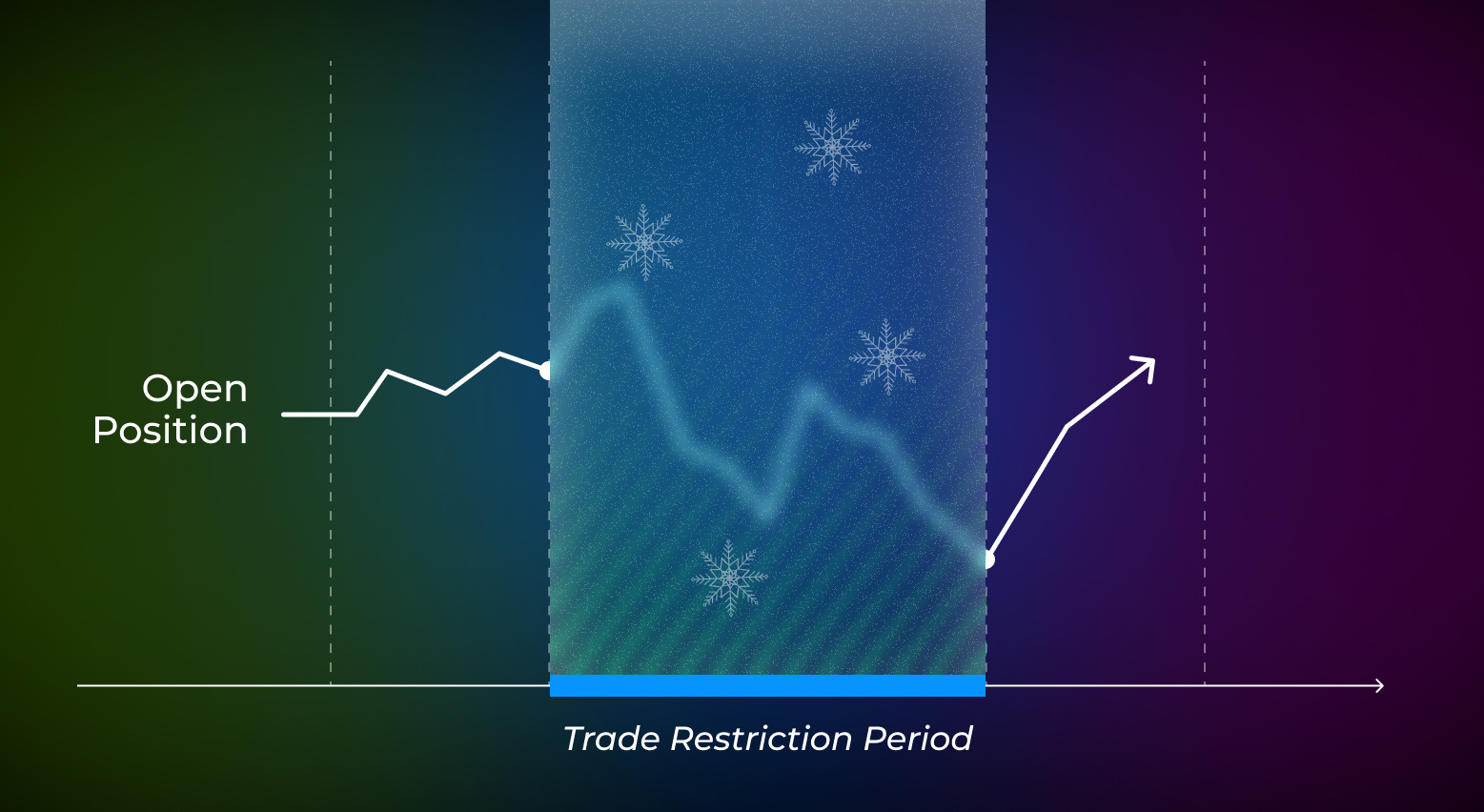

Trade restriction periods are a powerful risk-management tool for brokers. When market volatility rises, liquidity conditions worsen, or client behaviour becomes unpredictable, applying temporary restrictions helps safeguard exposure and prevent large unexpected losses.

What Trade Restriction Period Means

A trade restriction period is a defined time window or event-based trigger during which brokers apply tighter rules. These may include reduced leverage, increased margin requirements, blocked trading on high-risk instruments, or stricter spread and execution controls. The goal is to limit risk when market conditions or trader behaviour raise red flags.

When to Use Restriction Periods

Restriction periods make sense when: – there is high volatility or thin liquidity, – certain instruments show abnormal price behaviour, – clusters of traders begin to act in concert, creating concentrated exposure, – or when internal data suggests elevated risk of adverse selection or latency exploitation.

Using restrictions proactively — not after a major loss — gives brokers a chance to protect margin, manage flow, and reassess exposure before things get critical.

How Restrictions Are Applied and Managed

When a restriction period is triggered, the system enforces predetermined rules automatically. This can include limiting trade size, disabling high-risk instruments for new positions, increasing required margin or leverage thresholds, or enabling additional internal checks. Restrictions remain in effect until the broker resets them after reassessing risk conditions.

The enforcement is transparent and auditable: every blocked order, margin adjustment or rule activation is logged so risk and dealing teams can review and adjust policy if needed.

Benefits of Using Trade Restriction Periods

- Prevents excessive exposure during volatile or uncertain markets.

- Reduces risk of large unexpected losses from clusters, latency issues or market events.

- Gives risk teams time to reassess book composition and act deliberately rather than react under pressure.

- Supports more stable liquidity and routing decisions by damping sudden spikes in demand or stress flow.

- Makes risk policy predictable, consistent and easier to audit.

Typical Scenarios & Use Cases

Examples of when brokers may apply a restriction period: – Major economic announcements leading to sudden volatility, – Illiquid trading sessions with thin order books, – Detection of abnormal client-cluster behaviour or unusual order flow, – After large drawdowns or exposure spikes to prevent cascading risk.

In each case, restrictions act as a safeguard mechanism — not as a permanent policy — and help buy time to assess and rebalance risk.

Best Practices for Brokers

When implementing restriction periods, brokers should: – Define clear triggering criteria (volatility thresholds, flow anomalies, client-behaviour flags), – Pre-configure rules and fallback options so controls apply automatically, – Monitor the impact live via dashboards and exposure metrics, – Communicate internally so dealing and risk teams know when restrictions are active, – Review and adjust once conditions stabilise.

Conclusion

Trade restriction periods are an essential tool for managing uncertain or dangerous conditions. When used thoughtfully and proactively, they offer protection, preserve capital, and maintain stability — even when markets shake or client behaviour shifts unexpectedly. For brokers focused on long-term resilience, restrictions are a smart part of the risk toolkit.

Request a demo to see how trade-restriction controls can work in real time with your current broker setup.