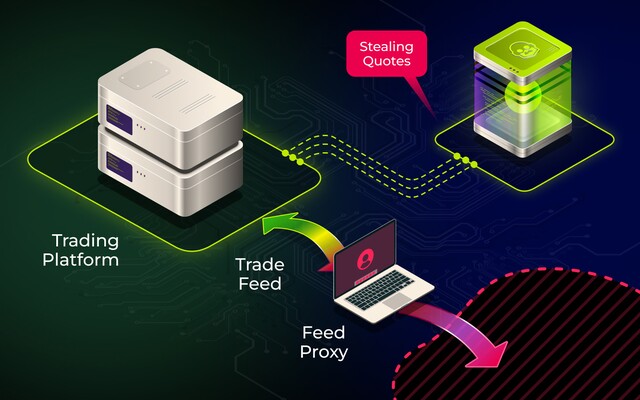

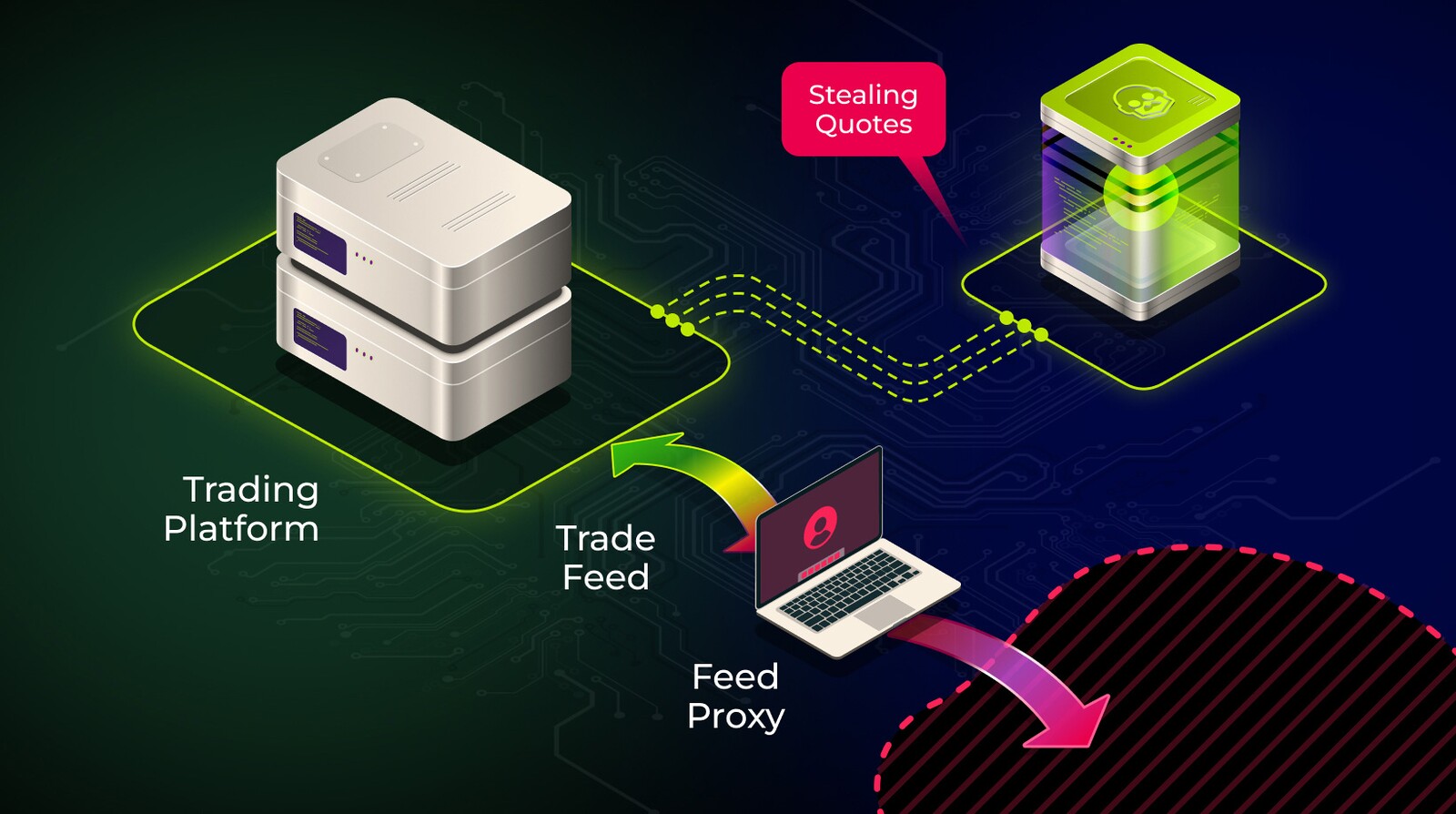

Stealing quotes refers to trading behaviour in which clients attempt to benefit from delayed or stale prices. When execution arrives faster for the trader than the broker updates their own quote feed or bridge, a small latency gap can be exploited repeatedly. Although the individual gains may appear minor, consistent patterns of this behaviour can create material P&L losses for a brokerage over time.

What Stealing Quotes Looks Like in Practice

The behaviour typically emerges when clients react to market movements more quickly than the broker’s system updates quotes or routes orders. A trader might submit orders at a price that no longer reflects the true market, capturing an advantage created by the delay. This is often seen during high-volatility moments, illiquid sessions or periods when the broker’s quote feed experiences temporary congestion.

While not always intentional, the result is the same: the broker fills orders at unfavourable levels, and the discrepancy accumulates into measurable P&L impact.

Why This Behaviour Is Difficult to Detect Manually

Spotting stealing-quote activity requires more than simply reviewing fills or timestamps. The timing issues are subtle and often buried within large volumes of normal flow. Manual analysis struggles because:

- The price difference may be only a fraction of a pip per trade but highly consistent.

- Only certain symbols, sessions or liquidity conditions may be affected.

- The behaviour can appear and disappear quickly as traders adapt to conditions.

- Different execution paths or bridges may introduce uneven latency.

Without a system that evaluates timing patterns, it is difficult to distinguish legitimate trading from activity that exploits micro-delays in market data or routing.

How Brokerpilot Detects Stealing-Quote Patterns

Brokerpilot continuously evaluates execution timing, quote freshness and the relationship between trader actions and market movement. When the system identifies trades that consistently take advantage of stale prices, it highlights the accounts, symbols and time periods involved.

Detection focuses on:

- The age of the quote at the moment of execution.

- The speed of the trader’s reaction to market ticks.

- How often the trader benefits from price discrepancies across sessions.

- Differences between expected and actual routing behaviour.

This creates a clear view of whether the broker is dealing with opportunistic latency abuse or normal trading under fast conditions.

Operational Value for Brokers

Understanding stealing quotes helps brokers quantify risk, improve routing stability and maintain a fair environment for all clients. By observing the scale and frequency of timing advantages, teams can determine whether the issue stems from infrastructure, liquidity conditions or client behaviour.

Consistent patterns may prompt brokers to:

- Review quote distribution and bridge performance.

- Apply tighter execution limits for high-risk sessions.

- Increase monitoring on specific symbols or client groups.

- Calibrate internal risk controls to reduce exposure to stale-price execution.

Example Use Case

During a period of elevated volatility, certain instruments may update more quickly on the market feed than on the broker’s internal system. If traders repeatedly execute against the slower feed, the broker fills orders at a disadvantage. Over hundreds of small trades, this behaviour compounds into measurable losses. Detecting these patterns early allows the dealing desk to investigate routing delays and take corrective action before the impact grows.

Next Steps

A live demonstration can show how stealing-quote patterns appear inside the Brokerpilot interface and how timing, quote age and execution flows are analysed in real time. These insights help brokers refine their risk posture and ensure that trading conditions remain balanced and transparent.

Request a demo to explore how Brokerpilot detects and manages timing-sensitive behaviour that may otherwise go unnoticed.