Most brokers have account types with fixed spread, which are generally attractive to clients who are willing to pay for a fixed spread in exchange for a guaranteed entry price with no order slippage due to spread widening.

But not every broker knows how to manage such accounts in terms of risk management, as some clients may abuse such conditions and make unreasonable profits.

Most important here are quotes at night, when there is very low liquidity on the market on instruments with a floating spread — at this time the spread expands significantly, while on symbols with a fixed spread the spread remains fixed, as a result there is a good environment for the arbitrageurs.

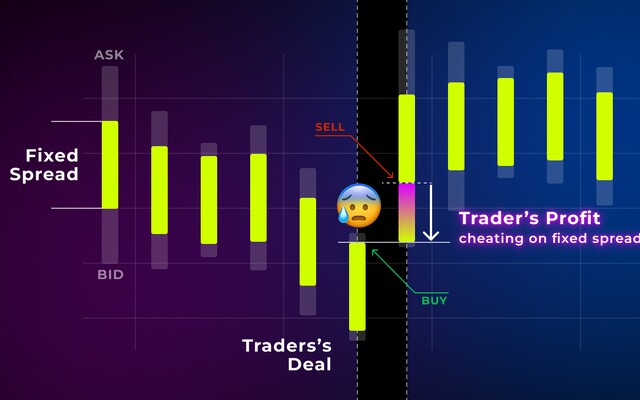

What the arbitrageurs do — with the help of various utilities, advisors, etc., they compare market quotes with the broker's fixed ones. When there is a real spread expansion — quotes with a fixed spread start jumping, since the bid price will always be lower than the ask price by a fixed spread value, or vice versa, the ask price will always be higher than the bid price by a fixed spread value. Thus, when the ask price goes far from the standard values, the bid price pulls up behind it and forms a hairpin on the chart, and as a rule, this hairpin closes quickly, but with the help of trading advisors and utilities, the arbitrageur can quickly get a profit from this.

Quotes with a floating spread do not draw such hairpins, because if the ask price goes far from the standard values, the bid price remains in place and an expanded spread is formed, the arbitrageur will not get into such a wide spread.

With the help of the “Spread by Period” trigger in Brokerpilot, brokers can set the spread widening on fixed quotes from for example 23:00 to 06:00 AM, because that's when liquidity drops a lot and the spread widens. As a rule, a normal client will not be active at this time, so such spread widening will not affect his trading statistics.