In our case “Spread by Period” we have demonstrated when the trade is possible on a fixed spread. In that trigger a dealer can control and manage the fixed spread and also can set the time period of the fixed spread.

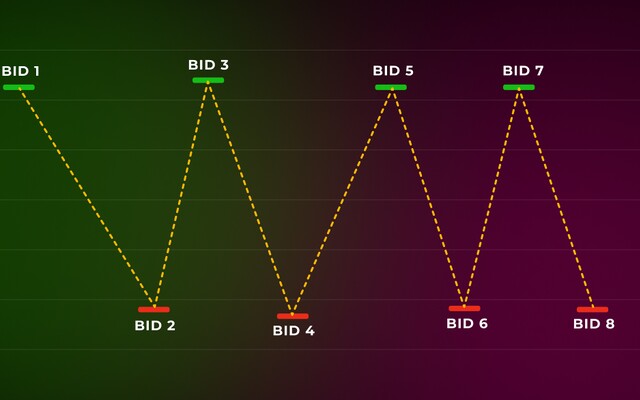

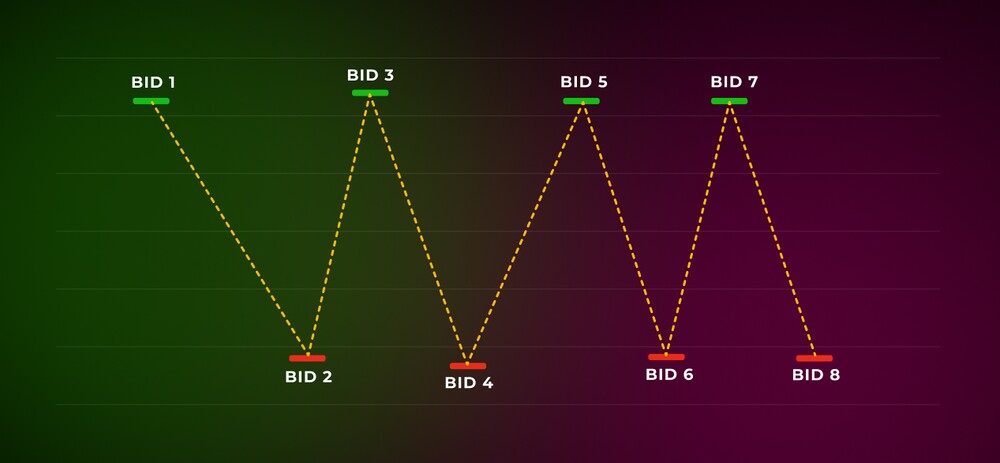

Today we will show the trigger that can visualize the exact instruments that draw such an unusual chart — “the saw” chart. This trigger is called “Series of bad rates”.

There could be three situations when such a chart can be detected:

- Your fixed spread is jumping;

- The quotes flow becomes unstable due to low liquidity and a “saw” is formed on the chart, which traders can abuse by using limit orders to open and close positions;

- The LP’s quotes flow breaks down and two different tickers start to merge into one stream. For example, USDJPY + EURUSD into one EURUSD chart.

Trading on such an “instrument” must be stopped immediately, and the trigger “Series of bad rates” will promptly notify dealers about the problem. Otherwise, you will then have to cancel transactions already made by traders on non-market quotes, you will have to argue with clients, deal with complaints to regulators, negative reviews on forums, and so on.