Overdue credits are an often underestimated source of risk for brokers. When negative balances, unpaid rollovers or delayed settlements accumulate, they distort exposure, weaken liquidity planning and place additional pressure on dealing and risk teams. Even small amounts can compound into larger operational problems if they are not monitored consistently.

Why Overdue Credits Matter

Every overdue credit represents a gap between the expected and actual state of a client’s account. These gaps influence risk in several ways. They may inflate exposure, shift margin requirements or obscure how much capital is truly available. For brokers operating with high volumes of retail flow, such discrepancies can affect routing decisions, hedging choices and reaction time during volatile periods.

Another challenge is that overdue credits rarely resolve themselves quickly. They often remain unnoticed until they reach a level that requires direct intervention. By then, the broker may already face increased financial pressure or sudden inconsistencies across accounts.

How Overdue Credits Develop

A typical overdue credit may arise from negative balance situations, insufficient equity to cover fees, delayed settlements or missed adjustments after corporate actions. In many cases these events are small in isolation. Problems appear when multiple unresolved items accumulate across many accounts, turning into a material distortion on the broker’s book.

Operational delays, manual reviews and fragmented data flows all increase the likelihood that overdue credits remain unaddressed. Without automated checks, teams must rely on periodic reports, which can miss critical changes between review cycles.

How Brokerpilot Helps Monitor the Risk

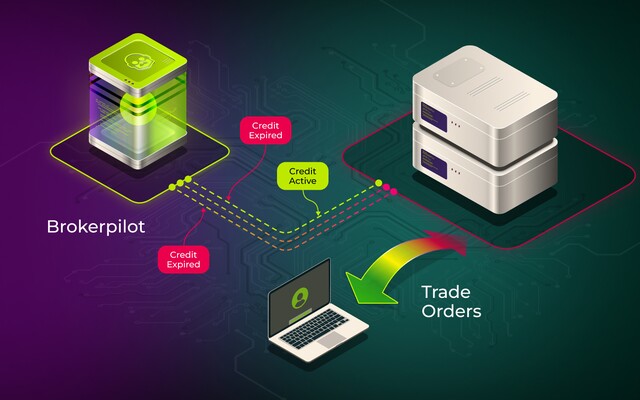

Brokerpilot tracks overdue credits in real time and highlights accounts where conditions require action. Instead of waiting for end-of-day reports or manual audits, risk teams receive immediate visibility into the impact of unresolved balances on exposure and equity. The system also reveals patterns — such as repeated occurrences in specific client groups or symbols — allowing brokers to address root causes rather than reacting to isolated events.

Dashboards present total overdue amounts, their distribution, and their influence on the broker’s risk posture. When thresholds or predefined conditions are exceeded, alerts ensure that action is taken before issues escalate. This approach reduces operational strain and improves the accuracy of exposure monitoring.

Business Impact

- Lower risk of unexpected losses caused by unmonitored negative balances.

- More accurate exposure calculations during fast or calm markets.

- Better internal liquidity planning and capital management.

- Reduced manual workload related to account reviews and adjustments.

- Clear visibility into recurring problem areas and client behaviour patterns.

Example Use Case

Imagine a period of increased volatility where several clients experience rapid drawdowns. If adjustments are delayed or not applied uniformly across accounts, a cluster of overdue credits may form. Without real-time monitoring, these discrepancies can overstate available equity, distort exposure and trigger incorrect routing or hedging decisions. With automated visibility, the dealing desk can intervene earlier, resolve the discrepancies and stabilise the book before the impact grows.

Next Steps

If you want to explore how overdue credits appear inside your current setup, a live demonstration can show how Brokerpilot identifies and tracks such cases across accounts, symbols and trading sessions. The insights help teams maintain cleaner books, reduce operational risks and operate with more predictable exposure.

Request a demo to see how overdue credit monitoring supports your risk and dealing workflow in real time.