Most brokers provide negative balance protection for their traders. Negative balance protection means that even if markets move rapidly against your trades, your account will not be negative. This is especially important to new traders that may not be familiar with how rapidly markets move during announcements, market openings or general market volatility.

Negative balance protection ensures that traders with losing positions don’t end up with a negative balance in their trading account. If you find yourself in a bad trade and are losing money fast, a margin call can save you from going into debt. Simply put, a stop out automatically closes your rapidly dropping open positions.

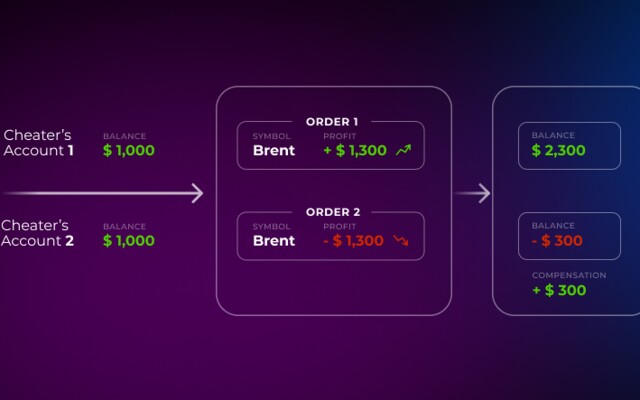

And as it often occurs some traders are trying to abuse this helpful feature to gain an unfair profit. Traders use multiple accounts to open trades with opposite directions. And not very uncommon to use all their balance for that. So as a result on one account the trader gets a profit and on the account with opposite trade he gets a stop out. But because of the negative balance protection of the broker, the trader's profit becomes “doubled”.

In Brokerpilot there are several ways to identify such trader’s behavior. First you should always check your stop out compensations of the trading session that we have put on your current session page.

If you see that their volume is too big, you need to go to the “Deposit and Withdrawal” section, apply the “Stop Out Compensations” filter, identify those accounts that received compensation and look for accounts that may match them in “Aggregated Accounts” section by IP, CID, ID, name or email.

“Aggregated Account” section of Brokerpilot allows you to find accounts associated with each other, located not only on different trading servers, but also on different trading platforms.

Additionally brokers can mitigate these risks by changing leverage of the accounts for the weekends in the “Leverage by Equity” trigger.

We have many successful cases of working against cheating schemes on stop-out compensation, when the cheaters counted on the fact that brokers do not have any functionality to consolidate such activity into a single report.