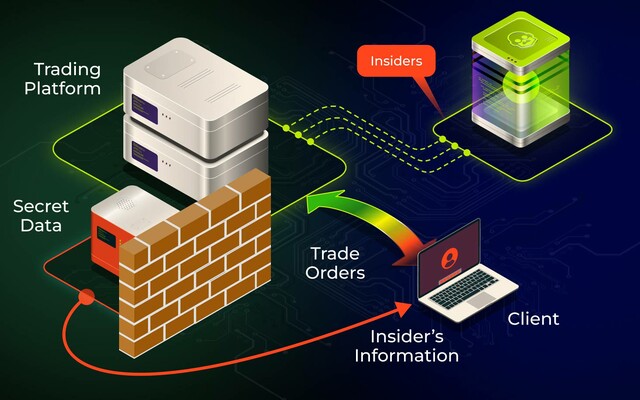

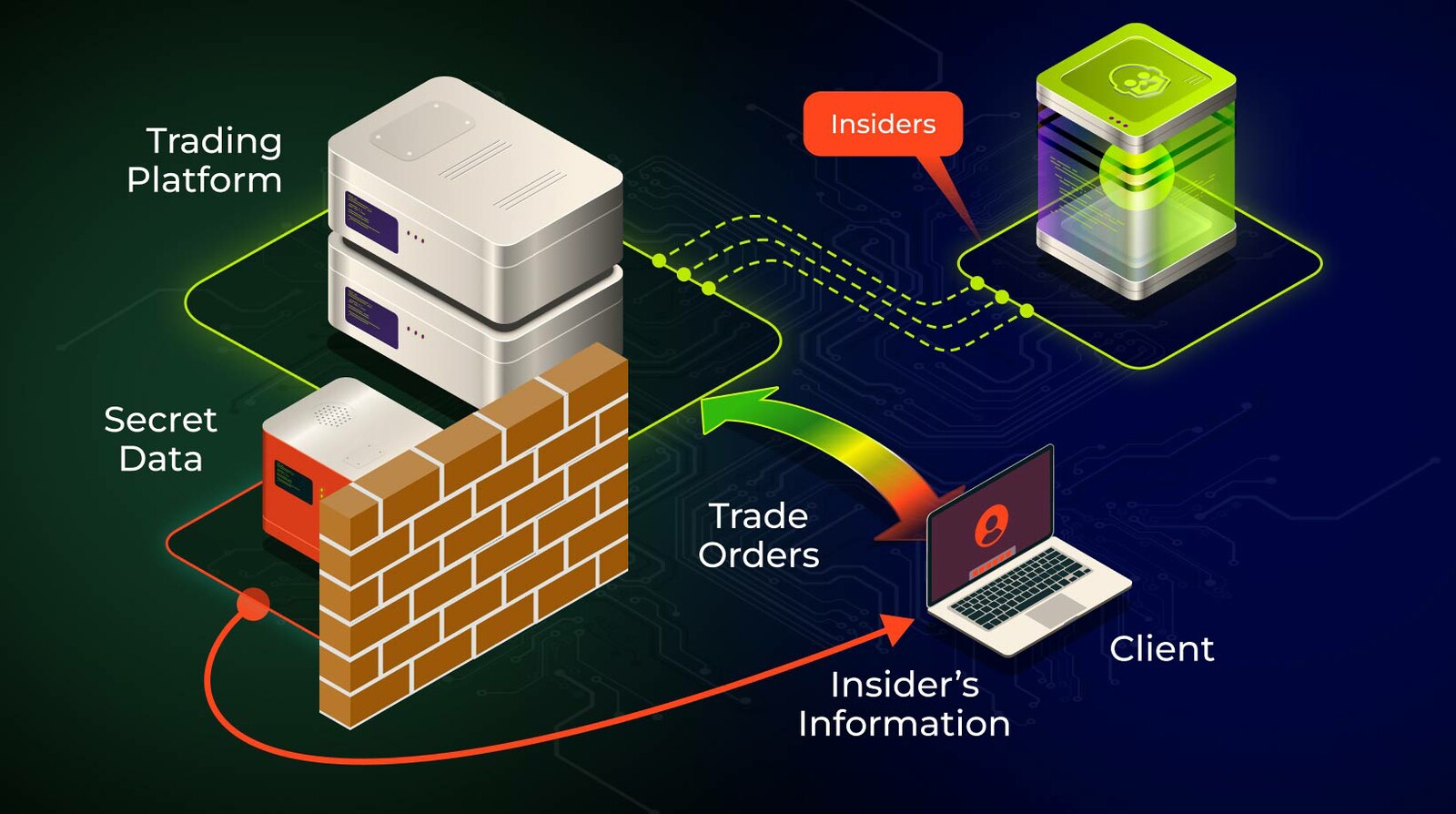

Insider trading is when a person knows about some major event within his company and uses this knowledge to make a profit. This could be for example some major merger event, the publication of a positive or negative financial report or some major deal between the companies. And an employee, knowing the inside information, comes to a particular broker, opens an account for a large amount, and before the news about the event comes to the market, opens a very large position and makes money very quickly from a surge in volatility.

The “Insiders” trigger will help dealers identify such transactions. Upon notification, we cannot guarantee that the account that falls under the conditions of the trigger is an insider. In this case Brokerpilot will act as a rough filter that highlights suspicious accounts and transactions. The trading volume must be very unusual for this account. We simply highlight that the trader suddenly made unexpectedly sharp profit. In this regard the trigger logic is very simple. In the notification we mention that this may be an insider, the dealer needs to check the received information.

The verification should include a detailed analysis of the client's account. When did he come to the broker, from what company, check the account using CRM, how he traded before, how much money he deposited into the account, etc. This is the only way to determine if this client is a cheater or not. Because insider trading is a criminal offense and should be treated as such.

This trigger should be configured very carefully in order to eliminate a large number of false positive notifications. Because checking each of these notifications will take quite a lot of time and thus notifications should be as relevant as possible.