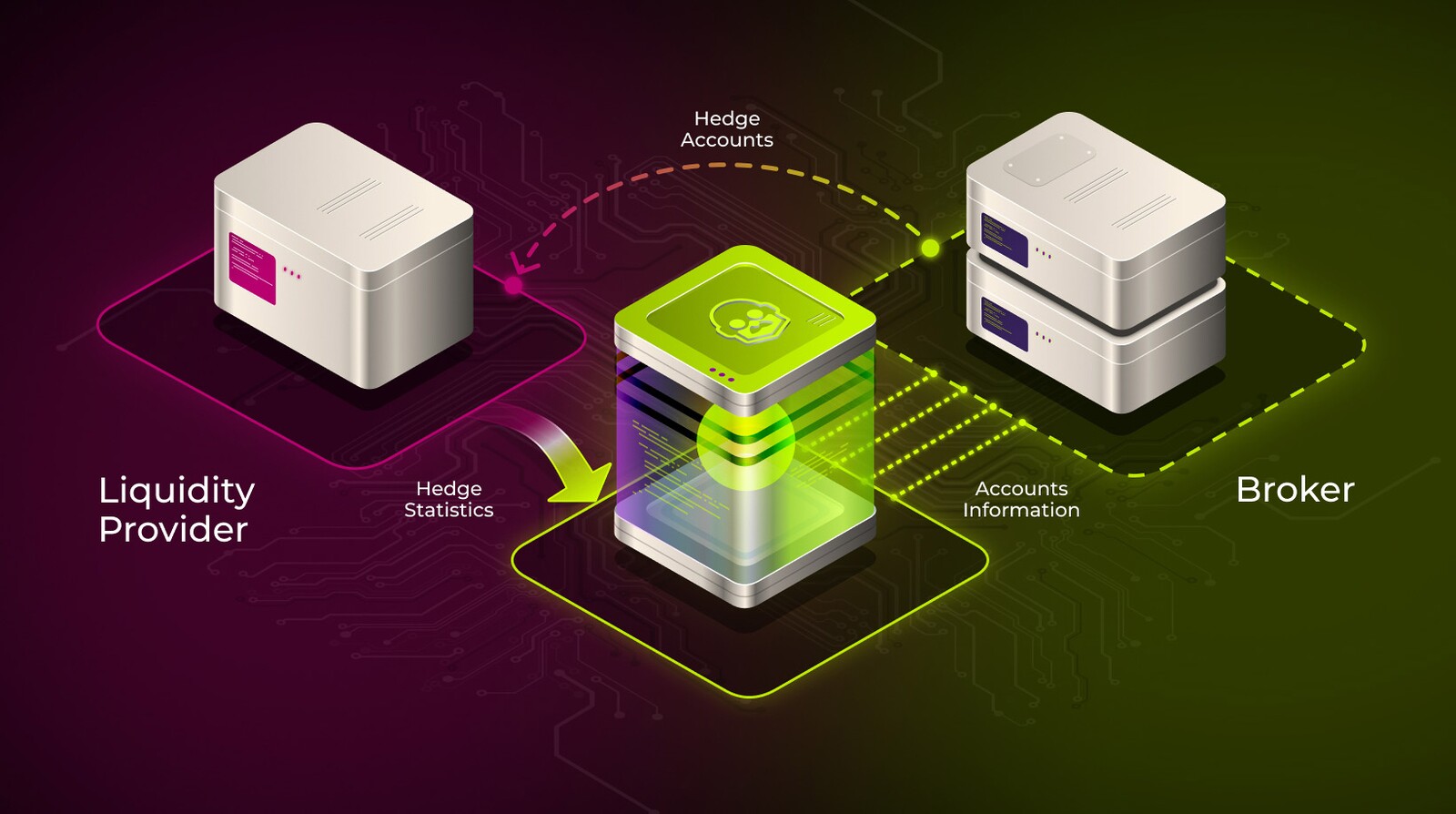

If a broker has hedge accounts opened with a third-party liquidity provider, they can be directly connected to Brokerpilot. This way our clients can monitor the status of hedge accounts in real time without having to switch between different applications.

A hedge account is required to open oppositely directed volumes on trading instruments that present a high risk in the broker’s current dealing. For example, a broker sees that there are too many “buy” transactions currently open for one instrument, but there are no counter transactions in dealing. In that case the broker refers to other brokers and opens accounts with them, on which he places for “sale” the volume of transactions that creates a risk for him.

If there are several hedge accounts with different liquidity providers, the broker needs a tool that will allow him to monitor these accounts in one place.

And Brokerpilot provides such functionality. It allows our clients to bring together into a single report the volumes in Brokerpilot, from the broker’s trading servers, and the total volumes of hedge accounts.

Broker can see a list of connected hedge accounts and on what platforms they are open, see the details of these accounts: what positions are open on them, margin requirements, on which instruments what volumes are open and what percentage of volumes on a trading instrument is covered by the hedge account.

Additionally, Brokerpilot has two triggers that can be applied to hedge accounts:

• Margin level — monitors the margin level on the broker's hedge account;

• Swap Change Alert — this trigger monitors swaps on hedge sources, and notifies the broker if the swap values have been changed.