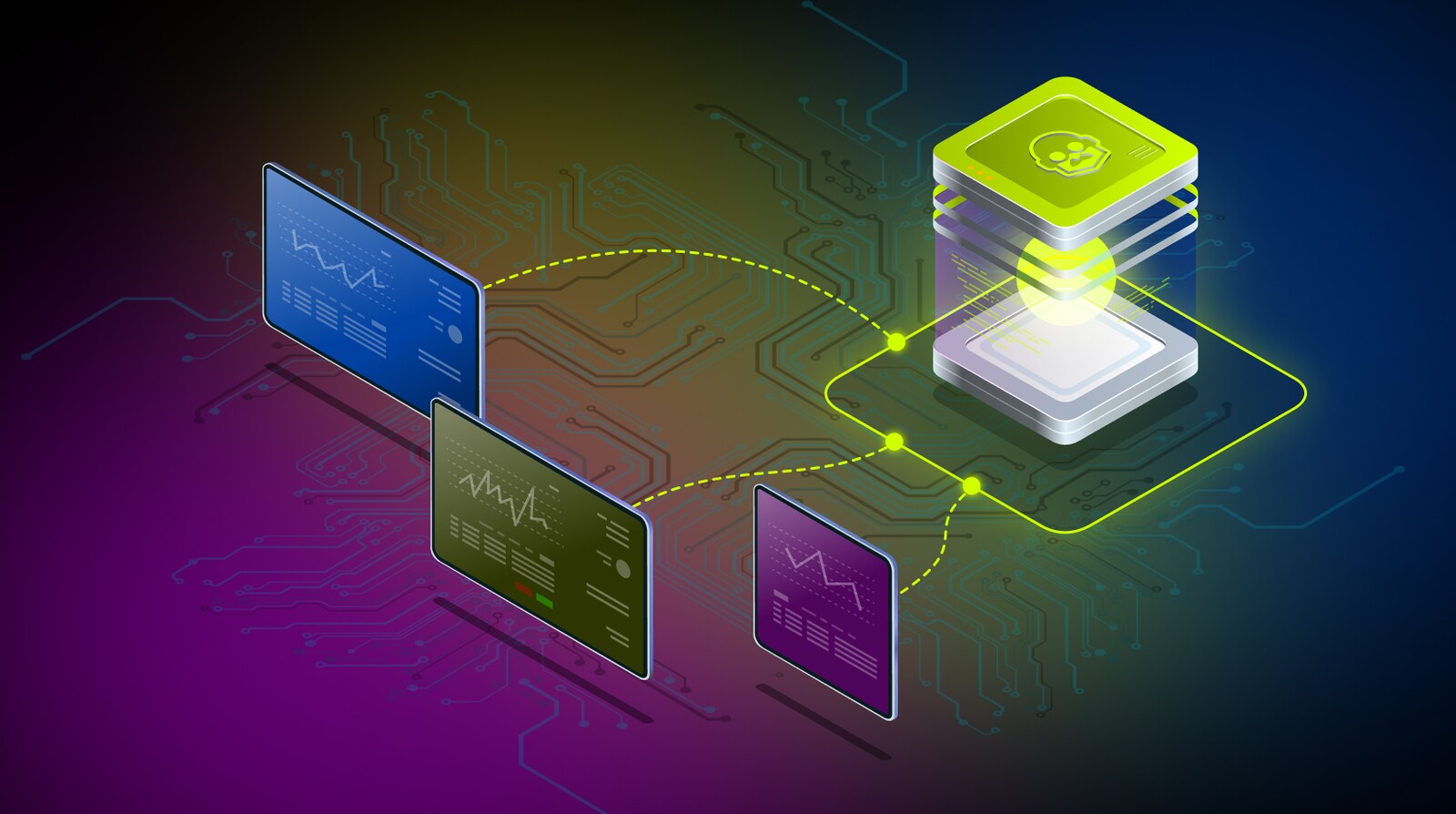

Brokerpilot dashboards provide brokers with a real-time, consolidated view of their risk environment. Instead of switching between multiple systems, dealing and risk teams can see exposure, P&L, client activity and symbol behaviour in one place. The dashboards are designed to highlight what matters now and reduce the noise that slows decision-making.

What the Dashboards Are Designed to Show

The system tracks how risk evolves second by second across instruments, client groups and liquidity venues. It combines trading data, hedging activity and the behaviour of internal controls into a single, up-to-date picture. This allows teams to immediately see which symbols are moving, which client segments are shifting their behaviour and where potential issues may soon arise.

Key Views Available to Brokers

- Exposure overview. A clear summary of net and gross exposure by symbol, direction and asset class, helping teams understand how market moves will affect the book.

- P&L patterns. Both realized and unrealized P&L are shown with context, making it easier to spot unusual movements or persistent trends.

- Client behaviour segments. Dashboards reflect how different groups of clients contribute to risk, profitability and overall flow quality.

- Control activity. Triggers, rule executions and parameter changes appear in the interface so teams can see which conditions were met and why certain actions occurred.

- Liquidity and routing indicators. Distribution of flow, fill quality and timing patterns between liquidity providers help identify issues before they affect execution.

Why Real-Time Dashboards Matter

Market conditions can change rapidly, and delays in reacting to these changes often lead to unnecessary risk. During calm periods, exposure drift or subtle behavioural shifts may accumulate unnoticed. Dashboards provide continuous visibility, reducing the chances of being caught off guard by sudden P&L swings or unexpected market events.

By simplifying how information is presented, the dashboards shorten reaction time and help teams make faster, more confident decisions throughout the trading day.

From Data to Actionable Signals

Although brokers generate large volumes of data, raw numbers alone rarely improve operational outcomes. Brokerpilot dashboards transform this information into structured, actionable insights. They emphasise:

- Clear thresholds. Predefined limits make it obvious when attention is required.

- Contextual detail. Suspicious symbols, time periods or client clusters can be explored further in just a few clicks.

- Event history. Past alerts and control actions are recorded to support investigation and compliance requirements.

How Dashboards Support Daily Workflow

A typical day for a risk manager might begin with reviewing overnight exposure and early-session P&L. Throughout the day, the focus may shift between fast-moving instruments, client groups with changing behaviour or controls that are approaching their limits. The dashboards ensure that the most important information is always front and centre.

This continuous visibility helps teams stay proactive rather than reactive, reducing operational pressure and improving overall risk stability.

Next Steps

If you want to see how dashboards look for your specific setup, a live demonstration can walk through real examples based on typical broker environments. During the demo, you can explore how exposure, P&L, client segments and controls are displayed in real time.

Request a demo to see how Brokerpilot dashboards integrate into your risk stack and help your team monitor and manage risk more effectively.