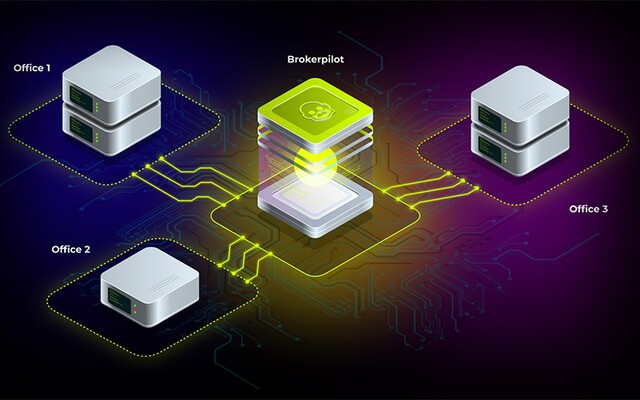

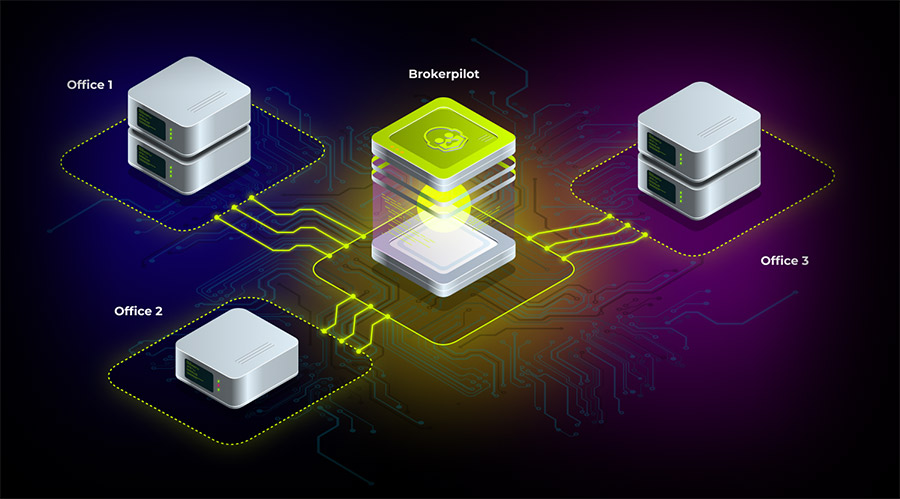

The clustering system in Brokerpilot is designed to help brokers truly understand their trader flow. Instead of looking at clients only as individual accounts, the platform groups them into behaviour-based segments that share similar patterns, risk profiles, and typical impact on the broker’s book.

What the Clustering System Does

At its core, clustering is an analytical layer that observes how traders interact with the market and with your infrastructure. It looks at factors such as reaction speed to quotes, instrument preferences, trading hours, sensitivity to volatility, hedging behaviour, and many other signals. Based on these patterns, Brokerpilot automatically assigns accounts to dynamic clusters that can be monitored and acted upon in real time.

This gives dealers and risk teams a way to see the structure of their book: which groups behave like normal retail flow, which show elements of toxic or arbitrage-style behaviour, and which are simply misaligned with current risk policies.

Why Segmenting Trader Flow Matters

Without clustering, all client trades blend into a single stream of exposure. High-frequency opportunistic traders, slow-moving investors and clients who mostly copy signals appear side by side, and risk decisions become reactive. Segmentation changes this picture. Once accounts are grouped by behaviour, brokers can:

- Monitor toxic or high-impact clusters separately from normal retail flow.

- Apply differentiated risk policies, margins or leverage settings per segment.

- Identify which client groups create unexpected exposure drift or timing risk.

- Understand which strategies are genuinely profitable for the broker over time.

In practice, this often reveals that a sm