There’s a moment in every broker’s journey when the numbers stop making sense. You look at the dashboard — everything seems fine. Clients are trading, spreads look healthy, and yet… your P&L quietly starts turning red. It doesn’t happen with noise or drama; it happens silently, over days or weeks, until one morning the book looks like it caught fire overnight. If you’ve ever been there, you know that feeling — the hollow mix of confusion and disbelief. You replay the trades, check liquidity connections, call your LP, and ask the same question everyone does:

“How did we miss this?”

That’s where the story of the risk stack begins.

What a “Risk Stack” Actually Is

The phrase sounds like tech jargon — but it’s not. Every broker already has a risk stack, whether they call it that or not. It’s the invisible set of systems, habits, and reactions that decide how quickly you see risk and how well you control it.

Think of it as your control room:

- Toxic flow detection — your radar; warns you about dangerous activity.

- Leverage control — your brake pedal; prevents runaway exposure.

- P&L protection — the seatbelt keeps you alive when something hits.

- Analytics and monitoring — your dashboard; they tell you where you’re heading before you crash.

Most brokers don’t lose money because of bad trading. They lose money because one layer of that stack fails — or never existed in the first place.

The Real Reason Brokers Lose Control

Let’s be honest: most brokers don’t blow up because of market volatility. They blow up because of delay.

Risk isn’t dangerous when you see it — it’s dangerous when you see it too late.

We once audited a mid-sized brokerage that had been showing solid profits for months. On paper, they looked fine. But when we dug deeper, we found that one of their data feeds was offset by a few seconds. That delay created a cascade — exposure values were being calculated on outdated prices. The system thought everything was under control, while the book was already tilting. When they realized what had happened, it was too late: a full day’s profit gone in an hour.

It wasn’t a bad system. It was a slow one. And slow, in this business, is fatal.

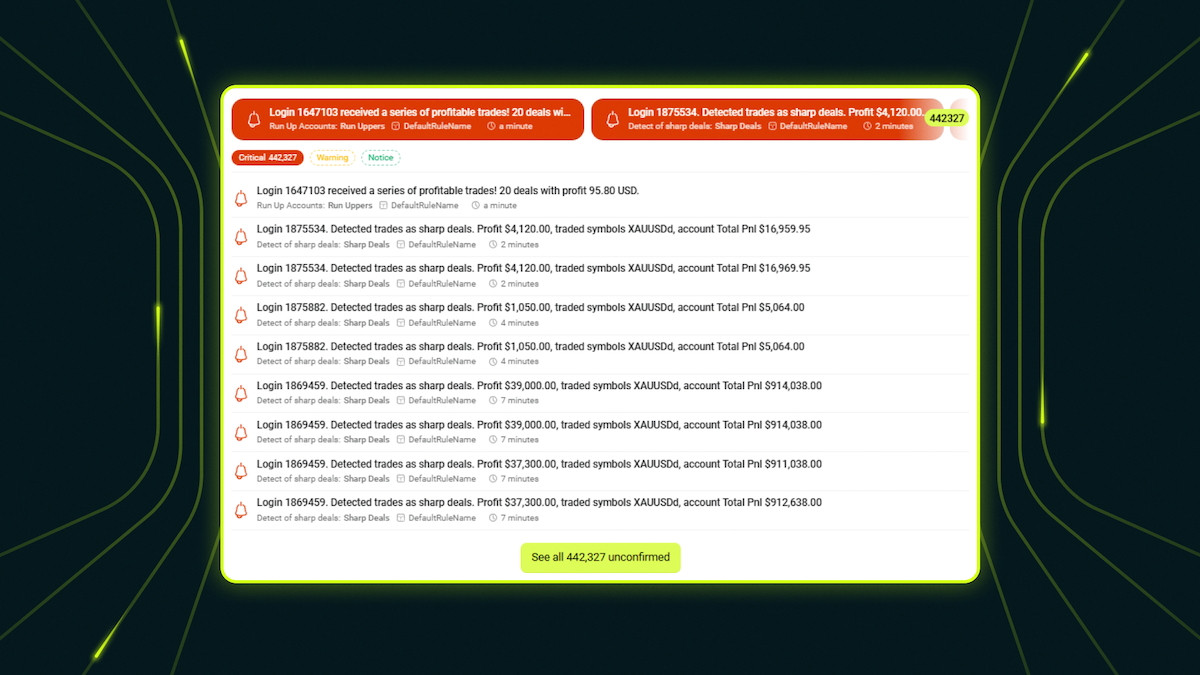

Toxic Flow — The Silent Killer

“Toxic flow” is a phrase every broker has heard, but few define precisely. It’s not just HFT or latency arbitrage. It’s any order flow that drains your capital faster than it builds your volume.

Sometimes it’s intentional — a client or bot exploits price delays, hunting for inefficiencies. Often it’s structural — a mismatch between your liquidity setup and the traders you onboard.

Toxic flow hides well. You don’t see it in client balances; you feel it in your slippage, in your spreads, in unexplained P&L shifts. By the time you open the exposure monitor, it’s already done the damage.

One broker we worked with noticed they were paying “too much” to their LPs but couldn’t explain why. Turned out, a single group of clients — using a legitimate EA — were flooding the system with micro-scalps across several symbols. Each trade looked fine, but together, they triggered liquidity rejections at the worst possible times. Their bridge was working; their risk logic wasn’t.

That’s toxic flow. Not always malicious, but always deadly if unseen.

The Leverage Illusion

Leverage is marketing’s best friend — and the risk team’s worst nightmare. 1:500, 1:1000 — these numbers attract clients fast. But every extra “zero” you offer adds real exposure to your firm.

The illusion is control. Brokers think they’re safe because they “set limits.” But if those limits aren’t adaptive — if they don’t react dynamically to volatility or client grouping — they’re useless.

We saw a case where a small broker offered high leverage on metals, thinking their exposure was balanced because positions were offset. Except one group of clients traded only during illiquid hours — their exposure wasn’t covered, and when prices moved three ticks in their favor, the broker’s margin pool collapsed. It wasn’t a market crash — just a perfect storm of leverage and timing.

Automatic leverage control isn’t about restricting clients. It’s about protecting brokers from their own generosity.

P&L — The Misunderstood Mirror

Ask ten brokers how they calculate their daily P&L and you’ll hear ten answers. Some treat it like a snapshot; others like a forecast. Few calculate it in real time.

A broker’s P&L isn’t a static number — it’s a moving picture. It reflects every exposure, every client group, every unhedged position, every latency spike.

In one case, a broker’s accounting showed profits while their liquidity accounts were draining. Why? One liquidity provider wasn’t reporting swaps correctly. Their internal system assumed those swaps were neutral. They weren’t. By the time they discovered it, they’d lost weeks of revenue.

That’s why we say: P&L isn’t about what you made — it’s about what you don’t yet see.

When the Stack Finally Talks to Itself

The real breakthrough happens when all layers of your risk management system start talking: when toxic flow alerts feed your leverage rules, and your P&L engine reacts before losses appear on paper. That’s when a broker stops reacting and starts predicting.

We call it total control, but it’s really about awareness. When you see your risk clearly, you don’t panic. You don’t blame the market or the clients — you simply adjust, instantly.

Imagine:

- Your system detects abnormal flow on XAU/USD.

- Automated leverage control lowers exposure in real time.

- P&L protection freezes profit-taking for those specific accounts.

- The dealing desk gets a friendly ping: “flow isolated — review pattern.”

No chaos. No panic. Just clarity. That’s what the Broker Risk Stack is built for — not to make brokers smarter, but to make the business calmer.

The Human Factor: Why Even Good Systems Fail

Technology does a lot, but it can’t replace common sense. Even the best risk management platforms fail if people ignore them.

We’ve seen brokers build complex dashboards that nobody opens after the first week. We’ve seen risk alerts buried under sales notifications. We’ve seen dealers who dismiss every red flag because “it’s just that client again.”

A real risk management culture isn’t about having more tools — it’s about listening to them. It’s about dealers, CTOs, and risk officers working in one rhythm.

At one firm, a simple change saved millions: they made the risk dashboard the first screen everyone saw when they logged in. Within a month, issues were spotted hours earlier. Within three months, their toxic flow detection accuracy improved by 40%.

Sometimes control starts not with code, but with attention.

Data — Your Only Honest Friend

Every broker says, “We know our flow.” The truth is — few really do, because most data is reactive. It shows what happened yesterday.

The brokers who survive every storm treat data as a living organism. They look not only at numbers, but at patterns:

- recurring exposure spikes;

- suspiciously “lucky” clients;

- sudden shifts in margin usage;

- liquidity rejects at odd hours.

Those patterns are whispers. Ignore them long enough, and they turn into screams.

One of our clients discovered that their “best traders” were actually net-negative for months. Their trades were timed around price feed delays. Without real-time flow analytics, that would have continued indefinitely. Instead, they spotted it, adjusted routing, and their P&L protection system finally stabilized.

Data doesn’t lie — it just waits for you to listen.

The Fear Nobody Admits

There’s a quiet fear every broker carries: that one day, the book will move faster than they can react. Not because they’re unskilled, but because risk has become invisible.

You don’t feel it until it’s too late — like a slow leak in a boat. One wrong liquidity feed, one delayed margin call, one client API gone wild... and your equity line suddenly falls off a cliff.

This isn’t drama. It’s reality. Every broker who’s spent a night refreshing dashboards at 3 a.m. knows it.

That’s why modern risk management for brokers isn’t about spreadsheets anymore. It’s about control speed — the time between risk emerging and risk being neutralized. That gap decides who survives the next wave of volatility.

Regulation Is Coming — And It’s Smarter Than Ever

For years, regulation felt like paperwork: reports, audits, compliance emails. Now it’s turning into real-time oversight.

Regulators expect brokers to prove they monitor risk dynamically. Daily summaries aren’t enough — continuous visibility is becoming the standard. Soon, the question won’t be “Did you report it?” but “Could you have prevented it?”

The next generation of risk management platforms is moving toward automation — not because it’s trendy, but because it’s the only way to stay compliant and solvent at the same time. The Broker Risk Stack fits that shift perfectly: it’s not a product, it’s an ecosystem of visibility.

Why This Matters to Every Broker — Big or Small

Whether you manage five hundred clients or fifty thousand, risk doesn’t scale linearly — it multiplies.

Small brokers often think, “We’re too small to need complex systems.” But one toxic client can hurt a small firm more than a hundred can hurt a big one. Big brokers suffer from volume blindness — too much data, not enough focus. The only constant? Everyone underestimates how fast risk travels.

That’s why automated risk management tools aren’t a luxury anymore — they’re oxygen.

Lessons From the Front Lines

We’ve been inside the flow — not watching from a distance but sitting with dealers, CTOs, and heads of risk as they fight fires. A few lessons always repeat:

1. Risk never sleeps. Markets move while people rest. If your monitoring depends on manual checks, you’re already behind.

2. Toxic flow doesn’t announce itself. It hides in normal-looking trades until volume makes the problem visible.

3. Profit hides mistakes. When P&L looks good, nobody questions the process. But good numbers can mask broken logic.

We once worked with a brokerage that discovered their most “profitable” segment was actually causing structural losses. Their system calculated P&L per symbol but ignored hedging latency. For weeks they celebrated profits that weren’t real. When we helped them rebuild the calculation logic, the truth was painful — but it saved their business.

Experience gives you not paranoia, but humility.

When Risk Becomes Predictable

True control isn’t about stopping losses — it’s about predicting them. The brokers that thrive use trading risk management tools to model “what-if” scenarios in real time:

- What if gold volatility doubles overnight?

- What happens if 20% of clients hedge in the same direction?

- What if your prime LP rejects half your orders?

Running those simulations daily is no longer optional — it’s survival.

“We used to think of automation as cold and technical. Now it feels like breathing room. It buys us time to think.” — a risk officer we worked with.

That’s what automated leverage control and toxic flow detection provide — not distance from your flow, but time to act before it burns you.

The Psychology of Control

Brokers rarely talk about emotion, but risk is emotional: fear, pride, denial, exhaustion. Running a brokerage means living with constant tension — the need to grow and the need to survive.

The smartest brokers don’t chase perfect safety; they chase perfect visibility. Because fear only thrives in the dark. Once you can see every layer of your broker risk stack clearly, fear turns into focus. You stop guessing. You start deciding.

Technology Meets Intuition

People ask whether automation will replace human risk teams. It won’t. Technology doesn’t replace intuition; it sharpens it.

The best brokers combine machine precision with human sense. Algorithms spot anomalies; humans judge their meaning. A system might flag “unusual flow,” but a human knows whether it’s a market event or a trading strategy.

Future risk management is hybrid — automated where speed matters, human where context matters. We’ve seen firms where AI handles 90% of monitoring and humans make the final call. Those firms sleep well.

Small Fixes, Big Impacts

Sometimes control doesn’t require a revolution — just the right adjustment.

We helped a broker who thought they needed new infrastructure. All we did was re-map exposure limits between MT4 groups and add one rule in their P&L protection system. Losses dropped 70% in a month.

Another broker struggled with liquidity rejects. They blamed LPs, but the issue was internal — inconsistent time stamps between servers. Fixing a 200-millisecond delay stopped a week of chaos.

These stories aren’t glamorous. They’re real — and they remind us that most crises start small.

The Uncomfortable Truth

Most brokers are one unexpected spike away from disaster. Not because they’re careless, but because they rely on hope disguised as confidence:

- Hope that “clients will behave.”

- Hope that “volatility will cool down.”

- Hope that “our bridge will catch it.”

Hope isn’t a risk management strategy. Visibility is. Automation is. Humility is. Brokers who admit what they don’t know are the ones still standing after every storm.

A Different Kind of Edge

People talk about speed, liquidity, pricing, and marketing budgets. The real edge has never been any of those things. Brokers who last don’t just trade faster — they see faster.

They know exactly what’s happening inside their flow. They can tell within seconds whether a spike in profit is genuine or toxic. They understand the shape of their exposure like a pilot understands turbulence.

That’s the quiet strength clients, partners, and regulators respect. That’s what a mature broker risk stack delivers — visibility so complete that confidence becomes calm, not arrogance.

Where Brokers Go From Here

If you already feel the weight of risk, here’s the simple truth: you don’t need to rebuild your business. You just need to rebuild the way you see it.

Start with awareness:

- Are your risk controls connected, or isolated in silos?

- Do you know which clients actually generate toxic flow?

- Is your leverage model reactive or static?

- Do you trust your P&L — or just hope it’s right?

The answers decide how your next crisis unfolds. The best part? Every broker can improve, one layer at a time. You don’t have to buy a new platform tomorrow — just start connecting the dots you already have. Once you do, you’ll feel it: the quiet sense that your brokerage is no longer running on luck. It’s running on control.

Final Thoughts

Risk will always be part of trading. But losing control doesn’t have to be.

We’ve seen enough to know that the difference between brokers who survive and those who don’t isn’t the market, the clients, or even the tech stack — it’s how seriously they take visibility. Every crisis is a problem that stayed invisible for too long.

If there’s one message to take from this: turn the lights on. Look deeper. Listen to what your flow is trying to tell you. Everything else — growth, trust, profit — follows from there.

FAQ: Understanding the Broker Risk Stack

- What is a broker risk stack?

- It’s the full ecosystem of tools and processes — from toxic flow detection to automated leverage control — that lets a broker monitor, prevent, and respond to risk in real time.

- Why is toxic flow detection important?

- Most losses come from invisible behaviour patterns. Detecting toxic trading flow early prevents liquidity rejection, slippage, and unnecessary P&L damage.

- How does automated leverage control work?

- It adjusts clients’ leverage dynamically based on volatility, exposure, and instrument type, reducing the chance of margin collapse during sudden price moves.

- What is a P&L protection system?

- A real-time monitoring layer that compares actual exposure to projected outcomes, helping brokers avoid “paper profits” that hide real losses.

- Is automation replacing human risk managers?

- No. Automation extends human awareness. It filters noise, spots patterns, and gives risk officers time to make better decisions — before risk becomes a headline.