Traders often use automated tools and programs that can connect to quotes sources from different brokers in order to compare the quotes flows. When traders see that the quotes of one particular broker are lagging, they know it's an opportunity to execute arbitrage trades.

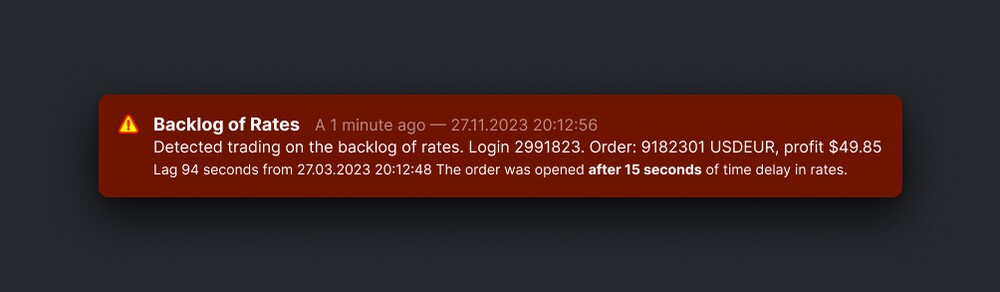

The logic behind the “Backlog of rates” trigger is remarkably straightforward. Brokerpilot monitors price quotes lags.

Imagine you have a gap in quotes in the EUR-USD pair, where there were no quotes for 30–40 seconds, and then a new quote arrives. Brokerpilot tracks what happened within that gap – if any of your traders opened a trade during that time. When the new quote arrives, your traders are already in profit. The trigger makes this instantly clear. It shows the profit, the lag in quotes, and the specific instrument. The notification also includes a tick chart. You'll notice a spike, and it becomes evident that these are arbitrageurs.

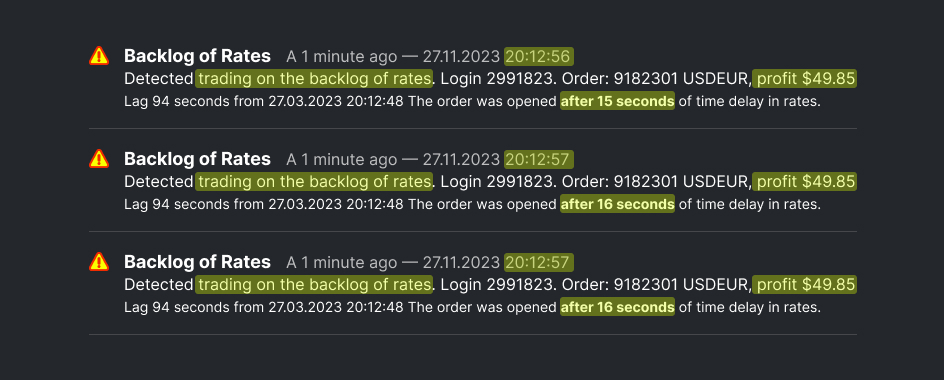

Our trigger is capable of capturing entire groups of such arbitrageurs. They do it discreetly, not going all in, using small amounts deals. But you can immediately spot multiple identical trades. You can see them on different servers, different clients, with the same trigger activation at the same time, the same entry points, exit points, the same instrument, and the same volume. You can spot these groups at once. Later, they may file complaints to the Financial commission, claiming they weren't allowed to withdraw their 'honest' profits.

However, Brokerpilot team is also a member of the Financial commission and possesses all the evidence of their activities, so their complaints go nowhere.

This relatively simple trigger is one of the most profitable tools for our clients. For example, the scenario we described — their single action earned them over $540. One action — $540, and then again and again. It all adds up. That way cheaters can discreetly siphon hundreds of thousands of dollars from broker’s PnL.