We would like to demonstrate how impossible it is for the broker to change trading terms without the automation sometimes, how fast the conditions can change and that a dealer has no chance to react without the tools presented in Brokerpilot. Without the automation the broker can suffer a huge loss in PnL.

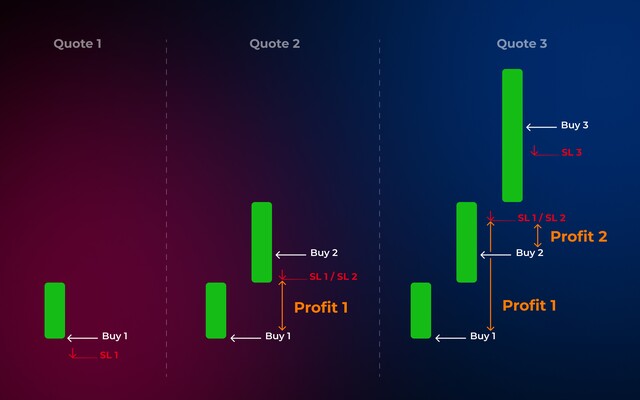

The picture below shows an example of the robot building a "pyramid" of open positions on the account, when it "caught" the trend and opens new deals, transferring the SL (stop-loss) to the break-even zone opened earlier. Thus the trader does not increase his risks by multiplying the profit exponentially. A profit is growing like a snowball and allows traders to boost new volumes. As a result, from $2,000–$5,000 a trader can earn up to $500,000.

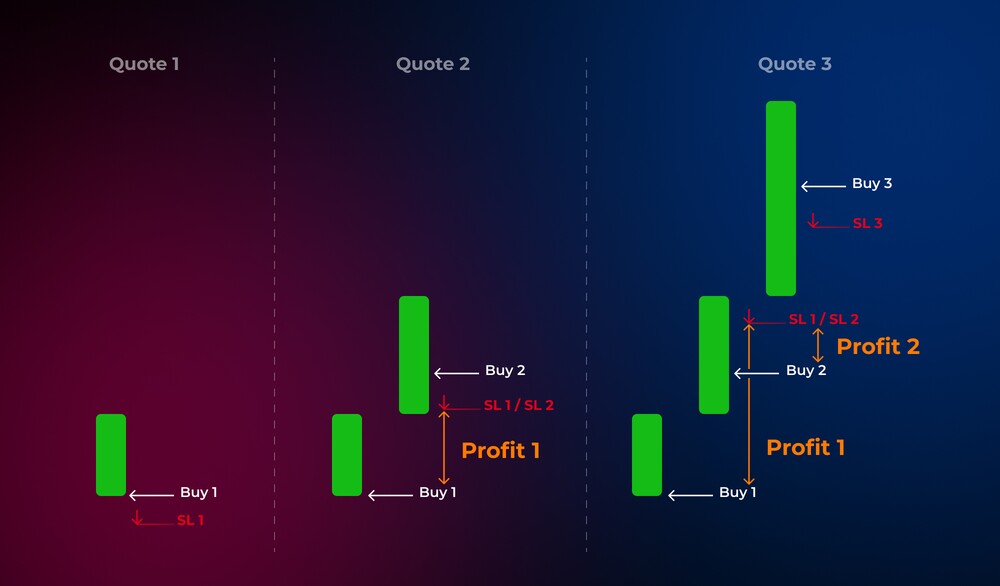

This picture shows how new volumes on the account will increase when using the Brokerpilot system of risk management. When the equity of the account grows, the system automatically reduces its trading leverage according to the established rules in the triggers “Dynamic Leverage” or “Leverage by Equity”.

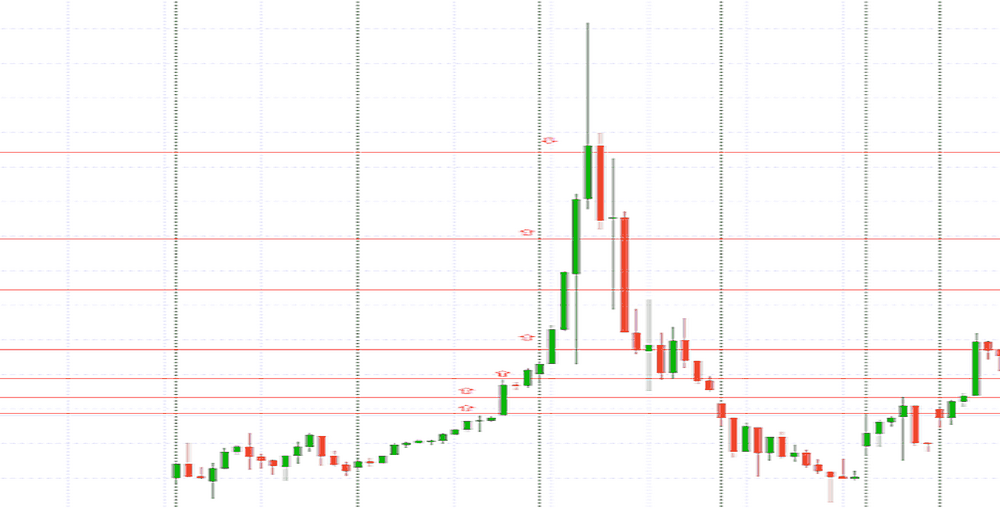

In addition, the “Abnormal volatility” trigger will alert dealers to fast price changes on the instrument. The “Doubled Accounts” trigger and the “Large Volumes by Account” trigger will react to the changes in the account. This will allow dealers to quickly expand the spread on the instrument, staying ahead of the trader.

In our picture examples of the EURRUB chart on December 15, 2014 are presented. But such high volatility often occurs on cryptocurrencies also. As a result, brokers across the industry are suffering losses. If there are thousands and tens of thousands of active accounts in the dealing, it is impossible to control anything at all without the automation.