Traders seek various methods to maximize their profits. Sometimes, they use multiple accounts to diversify their earnings and avoid detection by their broker. Brokers can encounter several challenges when traders employ multiple accounts in their cheating activities:

- Generating Trading Volumes: Traders create multiple accounts to boost their trading volumes and qualify for compensation or commissions in the broker's affiliate program.

- Currency Exchange: If brokers offer highly flexible deposit rates, traders may attempt to exploit them for currency exchange purposes.

- Cheating on Stop-Out Compensations: Cheating on stop-out compensations is an efficient method for quick profits.

To address these challenges, brokerage companies need to employ various methods to detect and prevent such activities. Brokerpilot can help you with that!

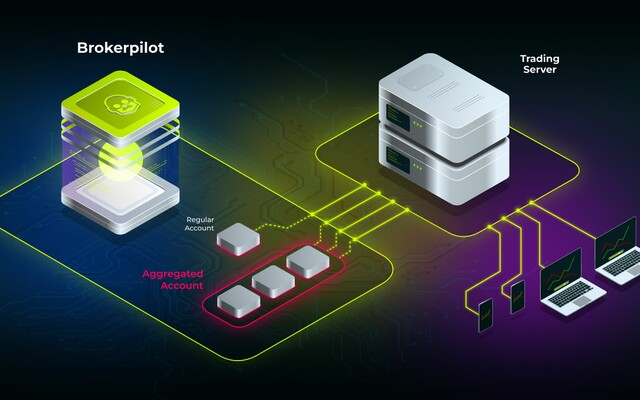

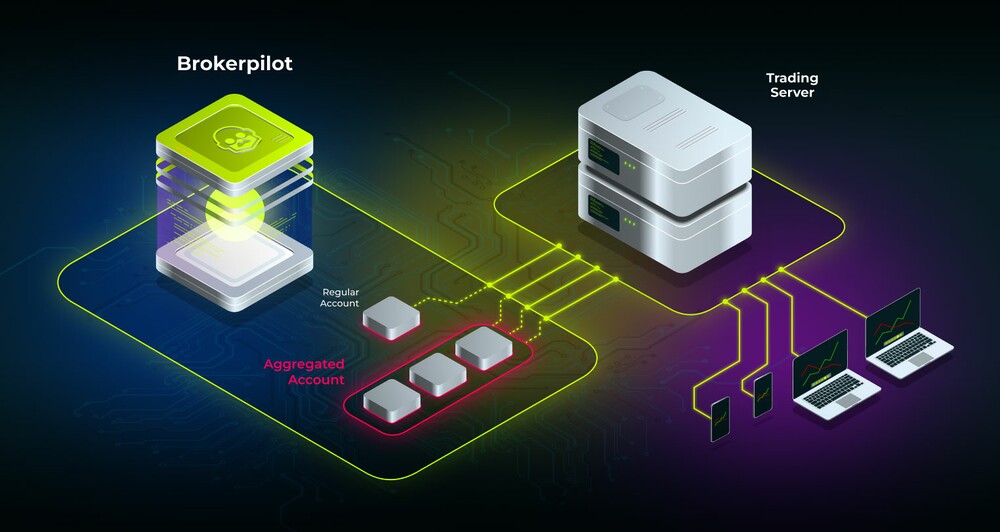

Aggregated Accounts and Related Profiles are essential tools for dealers to mitigate these risks.

Aggregated Accounts: Dealers can use the "Aggregated Accounts" tool to identify traders' activities by their IPs, CIDs, IDs, agent IDs, emails, and names. This tool provides a comprehensive overview, allowing brokers to assess the risk associated with individual traders or trader groups and take appropriate actions.

Related Profiles: Using this tool, dealers can pinpoint groups of traders working together in a coordinated manner, often referred to as "farms". This tool simplifies the analysis of their activities in trading, curbing undesirable practices like abusing the affiliate program, exploiting the broker for currency exchange, or attempting to receive stop-out compensations.