And why most risk failures don't come from chaos — but from comfort.

A few months ago, a small business headline made a louder sound in fintech circles than any central bank announcement.

It wasn’t about regulation, IPOs, or crypto.

It was a short column in a financial industry newsletter — almost accidental in its modesty — with a painfully dry title:

"Execution Latency Identified as Source of Quarterly Discrepancy in Retail Brokerage Book"

Not viral. Not dramatic. Not even clickbait.

But the story behind it was the kind you print and stick on a risk department wall.

The Setup (That Looked Perfect)

The brokerage in question was mid-sized, regulated, and technically well-equipped:

- 3 LP connections

- Redundant matching engines

- Real-time monitoring dashboards

- Spread deviation alerts

- High-frequency throttling

- Weekly risk committee meetings

In industry terms: clean, compliant, professional, boring.

Their average client profile was retail traders with small deposits, mostly FX majors, nothing exotic.

No scandal. No system failure. No “wolf on Wall Street” energy.

Which, ironically, was the problem.

The Symptom (That Nobody Saw as a Symptom)

For 9 consecutive weeks, the brokerage observed something odd but not alarming:

- EURUSD spread costs were 4–6% higher than peer average

- Client profitability was slightly elevated on low-volatility days

- LP rejections increased mildly, but still within internal tolerance

- A few “lucky” client clusters performed consistently well, but not suspiciously well

Every metric, individually, had an explanation. Together, they formed a sentence no one was reading.

There was no alarm. Just a vibe.

And vibes are not KPIs.

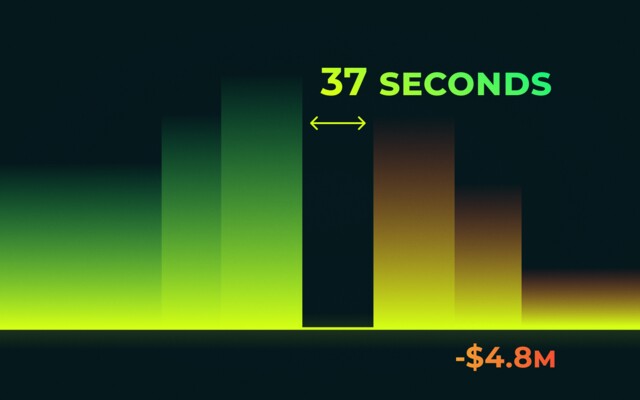

The 37 Seconds Nobody Measured

One afternoon, during a routine liquidity reconciliation — not even a risk investigation — an analyst accidentally noticed a pattern:

Market price → LP hedge → internal execution → client confirmation

happened in the correct sequence, but not always in the correct timing.

An average of 37 seconds. 37 seconds between price confirmation sent to the client and internal hedge execution finalised with liquidity providers.

In most days, irrelevant. In trending markets, manageable. In chopped liquidity pockets? A leak.

The Mechanics of a Quiet Disaster

No trading rules were broken. No toxic flow. No arbitrage bots. Clients weren’t colluding. No feed manipulation.

| Event | Ideal State | Actual State |

|---|---|---|

| Client execution | Instant internal hedge | Hedge delayed ~37 sec |

| Market volatility | Assumed symmetrical | Was micro-trending |

| LP exposure | Neutralized quickly | Accumulated briefly |

| Risk impact | Zero or negligible | Systematically one-sided |

During calm hours: nothing happened.

But when markets moved 8–12 pips in a tight channel, a predictable sequence emerged:

- Clients executed at price X

- Broker confirmed instantly

- Market drifted 3–6 pips before hedge was placed

- LP fulfilled hedge at X ± drift

- The drift became broker P&L impact

- Clients never saw it

- System logged everything as “successful execution”

- And the discrepancy quietly accumulated

The Twist? Clients Looked Smart, Not Malicious

Because of the delayed hedge, client-side executions had a curious statistical pattern: slight edge in entries, slight edge in exits, slight edge in micro-trends — never enough to trigger fairness thresholds.

The Bill

| Cumulative P&L leakage | $4.8M |

| Avg impact per trade | 0.03–0.17 pips |

| Harmful outliers | 0 |

| System alerts triggered | 0 |

| Rules violated | 0 |

It wasn’t a breach. It was unmeasured time.

The Uncomfortable Conclusion

“The firm built risk controls for bad behavior, but not for slow behavior.”

Everyone was monitoring wrong price, fast price, abusive price, off-market price, manipulation, latency arbitrage, toxic flow.

Nobody monitored correct price delivered too late.

Why This Story Matters in 2025+

Modern brokerage losses increasingly come from small unmeasured intervals, accumulated micro-exposure and acceptable inefficiencies at scale. In the era of sub-millisecond execution, seconds no longer look dangerous. Until they multiply.

The 3 Questions Every Broker Should Ask Now

- What happens in our book between execution and hedge?

- Is our exposure neutralized instantly or eventually?

- Do we measure time as a risk vector, not just price?

Risk isn’t only what you monitor. It’s also what you don’t measure.

Final Thought

The most expensive line in the investigation was not a code error, not a bad trade, not a market shock — it was the assumption: “If nothing is failing, nothing is wrong.”

The market didn’t break the system. The system gently bled into the market — 37 seconds at a time.